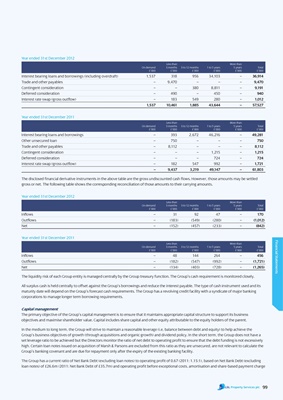

Year ended 31st December 2012

Less than More than

On demand 3 months 3 to 12 months 1 to 5 years 5 years Total

£’000 £’000 £’000 £’000 £’000 £’000

Interest bearing loans and borrowings (including overdraft) 1,537 318 956 34,103 – 36,914

Trade and other payables – 9,470 – – – 9,470

Contingent consideration – – 380 8,811 – 9,191

Deferred consideration – 490 – 450 – 940

Interest rate swap (gross outflow) – 183 549 280 – 1,012

1,537 10,461 1,885 43,644 – 57,527

Year ended 31st December 2011

Less than More than

On demand 3 months 3 to 12 months 1 to 5 years 5 years Total

£’000 £’000 £’000 £’000 £’000 £’000

Interest bearing loans and borrowings – 393 2,672 46,216 – 49,281

Other unsecured loan – 750 – – – 750

Trade and other payables – 8,112 – – – 8,112

Contingent consideration – – – 1,215 – 1,215

Deferred consideration – – – 724 – 724

Interest rate swap (gross outflow) – 182 547 992 – 1,721

– 9,437 3,219 49,147 – 61,803

The disclosed financial derivative instruments in the above table are the gross undiscounted cash flows. However, those amounts may be settled

gross or net. The following table shows the corresponding reconciliation of those amounts to their carrying amounts.

Year ended 31st December 2012

Less than More than

On demand 3 months 3 to 12 months 1 to 5 years 5 years Total

£’000 £’000 £’000 £’000 £’000 £’000

Inflows – 31 92 47 – 170

Outflows – (183) (549) (280) – (1,012)

Net – (152) (457) (233) – (842)

Year ended 31st December 2011

Financial Statements

Less than More than

On demand 3 months 3 to 12 months 1 to 5 years 5 years Total

£’000 £’000 £’000 £’000 £’000 £’000

Inflows – 48 144 264 – 456

Outflows – (182) (547) (992) – (1,721)

Net – (134) (403) (728) – (1,265)

The liquidity risk of each Group entity is managed centrally by the Group treasury function. The Group’s cash requirement is monitored closely.

All surplus cash is held centrally to offset against the Group’s borrowings and reduce the interest payable. The type of cash instrument used and its

maturity date will depend on the Group’s forecast cash requirements. The Group has a revolving credit facility with a syndicate of major banking

corporations to manage longer term borrowing requirements.

capital management

The primary objective of the Group’s capital management is to ensure that it maintains appropriate capital structure to support its business

objectives and maximise shareholder value. Capital includes share capital and other equity attributable to the equity holders of the parent.

In the medium to long term, the Group will strive to maintain a reasonable leverage (i.e. balance between debt and equity) to help achieve the

Group’s business objectives of growth (through acquisitions and organic growth) and dividend policy. In the short term, the Group does not have a

set leverage ratio to be achieved but the Directors monitor the ratio of net debt to operating profit to ensure that the debt funding is not excessively

high. Certain loan notes issued on acquisition of Marsh & Parsons are excluded from this ratio as they are unsecured, are not relevant to calculate the

Group’s banking covenant and are due for repayment only after the expiry of the existing banking facility.

The Group has a current ratio of Net Bank Debt (excluding loan notes) to operating profit of 0.67 (2011: 1.15:1), based on Net Bank Debt (excluding

loan notes) of £26.6m (2011: Net Bank Debt of £35.7m) and operating profit before exceptional costs, amortisation and share-based payment charge

99