Notes to the Group Financial Statements (continued)

for the year ended 31st December 2012

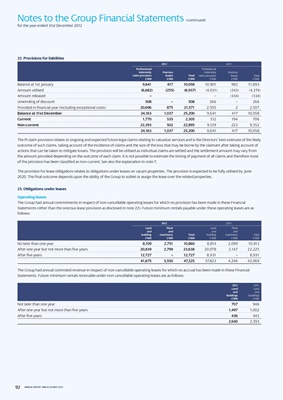

22. Provisions for liabilities

2012 2011

Professional Professional

indemnity onerous indemnity Onerous

claim provision leases total claim provision leases Total

£’000 £’000 £’000 £’000 £’000 £’000

Balance at 1st January 9,641 417 10,058 10,901 992 11,893

Amount utilised (6,682) (255) (6,937) (4,031) (243) (4,274)

Amount released – – (334) (334)

Unwinding of discount 508 – 508 266 – 266

Provided in financial year (including exceptional costs) 20,696 875 21,571 2,505 2 2,507

Balance at 31st December 24,163 1,037 25,200 9,641 417 10,058

current 1,770 535 2,305 512 194 706

non-current 22,393 502 22,895 9,129 223 9,352

24,163 1,037 25,200 9,641 417 10,058

The PI claim provision relates to ongoing and expected future legal claims relating to valuation services and is the Directors’ best estimate of the likely

outcome of such claims, taking account of the incidence of claims and the size of the loss that may be borne by the claimant after taking account of

actions that can be taken to mitigate losses. The provision will be utilised as individual claims are settled and the settlement amount may vary from

the amount provided depending on the outcome of each claim. It is not possible to estimate the timing of payment of all claims and therefore most

of the provision has been classified as non-current. See also the explanation in note 7.

The provision for lease obligations relates to obligations under leases on vacant properties. The provision is expected to be fully utilised by June

2020. The final outcome depends upon the ability of the Group to sublet or assign the lease over the related properties.

23. obligations under leases

operating leases

The Group had annual commitments in respect of non-cancellable operating leases for which no provision has been made in these Financial

Statements (other than the onerous lease provision as disclosed in note 22). Future minimum rentals payable under these operating leases are as

follows:

2012 2011

Land Plant Land Plant

and and and and

building machinery total building machinery Total

£’000 £’000 £’000 £’000 £’000 £’000

No later than one year 8,109 2,751 10,860 8,814 2,099 10,913

After one year but not more than five years 20,839 2,799 23,638 20,078 2,147 22,225

After five years 12,727 – 12,727 8,931 – 8,931

41,675 5,550 47,225 37,823 4,246 42,069

The Group had annual commited revenue in respect of non-cancellable operating leases for which no accrual has been made in these Financial

Statements. Future minimum rentals receivable under non-cancellable operating leases are as follows:

2012 2011

Land Land

and and

buildings buildings

£’000 £’000

Not later than one year 707 946

After one year but not more than five years 1,497 1,002

After five years 436 445

2,640 2,393

92 ANNUAL REPORT AND ACCOUNTS 2012