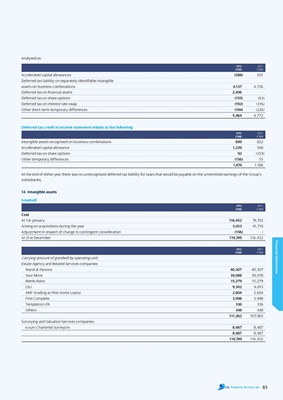

Analysed as:

2012 2011

£’000 £’000

Accelerated capital allowances (588) 651

Deferred tax liability on separately identifiable intangible

assets on business combinations 4,137 4,726

Deferred tax on financial assets 2,456 -

Deferred tax on share options (155) (63)

Deferred tax on interest rate swap (192) (316)

Other short-term temporary differences (194) (226)

5,464 4,772

Deferred tax credit in income statement relates to the following:

2012 2011

£’000 £’000

Intangible assets recognised on business combinations 699 822

Accelerated capital allowance 1,239 568

Deferred tax on share options 92 (259)

Other temporary differences (156) 55

1,874 1,186

At the end of either year there was no unrecognised deferred tax liability for taxes that would be payable on the unremitted earnings of the Group’s

subsidiaries.

14. intangible assets

goodwill

2012 2011

£’000 £’000

cost

At 1st January 116,452 74,742

Arising on acquisitions during the year 3,453 41,710

Adjustment in respect of change in contingent consideration (156) –

At 31st December 119,749 116,452

Financial Statements

2012 2011

£’000 £’000

Carrying amount of goodwill by operating unit

Estate Agency and Related Services companies

Marsh & Parsons 40,307 40,307

Your Move 39,088 39,078

Reeds Rains 15,279 15,279

LSLi 9,302 6,015

AMF (trading as Pink Home Loans) 2,604 2,604

First Complete 3,998 3,998

Templeton LPA 336 336

Others 348 348

111,262 107,965

Surveying and Valuation Services companies

e.surv Chartered Surveyors 8,487 8,487

8,487 8,487

119,749 116,452

83