The vesting of JSOP awards granted in 2010 is conditional upon LSL’s adjusted basic EPS performance meeting the following absolute performance

targets over a period of 3 financial years starting with the financial year in which the JSOP award is granted:

Value of shares under the JSOP

award at date of grant

(as a percentage of salary)

Chief Executive Senior

EPS growth p.a. 1 Officer Executives

10% 100% 100%

13% 150% –

17% 200% –

1

With straight line vesting between points for the Chief Executive Officer’s award.

The vesting of JSOP awards granted in 2011 is conditional upon both the following criteria being met:

• LSL’s Adjusted EPS performance over the three financial years starting with the financial year in which the JSOP award is granted being 10% p.a. or

more; and

• LSL’s TSR must exceed that of the FTSE 250 index (excluding investment trusts) over the three year performance period.

2012 2011

Weighted Weighted

average average

exercise exercise

price price

£ number £ Number

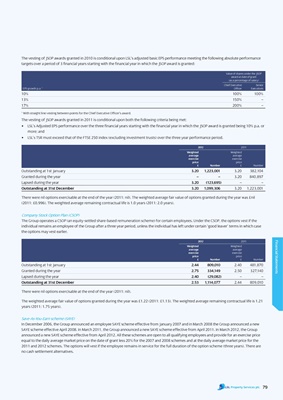

Outstanding at 1st January 3.20 1,223,001 3.20 382,104

Granted during the year – – 3.20 840,897

Lapsed during the year 3.20 (123,695) – –

outstanding at 31st December 3.20 1,099,306 3.20 1,223,001

There were nil options exercisable at the end of the year (2011: nil). The weighted average fair value of options granted during the year was £nil

(2011: £0.996). The weighted average remaining contractual life is 1.0 years (2011: 2.0 years).

Company Stock Option Plan (CSOP)

The Group operates a CSOP (an equity-settled share-based remuneration scheme) for certain employees. Under the CSOP, the options vest if the

individual remains an employee of the Group after a three year period, unless the individual has left under certain ‘good leaver’ terms in which case

the options may vest earlier.

2012 2011

Financial Statements

Weighted Weighted

average average

exercise exercise

price price

£ number £ Number

Outstanding at 1st January 2.44 809,010 2.40 481,870

Granted during the year 2.75 334,149 2.50 327,140

Lapsed during the year 2.40 (29,082) – –

outstanding at 31st December 2.53 1,114,077 2.44 809,010

There were nil options exercisable at the end of the year (2011: nil).

The weighted average fair value of options granted during the year was £1.22 (2011: £1.13). The weighted average remaining contractual life is 1.21

years (2011: 1.75 years).

Save-As-You-Earn scheme (SAYE)

In December 2006, the Group announced an employee SAYE scheme effective from January 2007 and in March 2008 the Group announced a new

SAYE scheme effective April 2008. In March 2011, the Group announced a new SAYE scheme effective from April 2011. In March 2012, the Group

announced a new SAYE scheme effective from April 2012. All these schemes are open to all qualifying employees and provide for an exercise price

equal to the daily average market price on the date of grant less 20% for the 2007 and 2008 schemes and at the daily average market price for the

2011 and 2012 schemes. The options will vest if the employee remains in service for the full duration of the option scheme (three years). There are

no cash settlement alternatives.

79