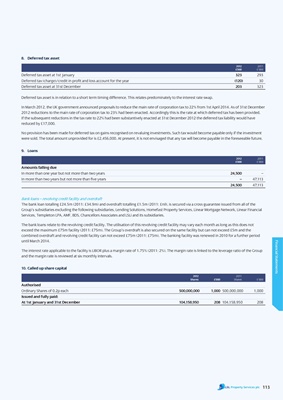

8. Deferred tax asset

2012 2011

£’000 £’000

Deferred tax asset at 1st January 323 293

Deferred tax (charge)/credit in profit and loss account for the year (120) 30

Deferred tax asset at 31st December 203 323

Deferred tax asset is in relation to a short term timing difference. This relates predominately to the interest rate swap.

In March 2012, the UK government announced proposals to reduce the main rate of corporation tax to 22% from 1st April 2014. As of 31st December

2012 reductions to the main rate of corporation tax to 23% had been enacted. Accordingly this is the rate at which deferred tax has been provided.

If the subsequent reductions in the tax rate to 22% had been substantively enacted at 31st December 2012 the deferred tax liability would have

reduced by £17,000.

No provision has been made for deferred tax on gains recognised on revaluing investments. Such tax would become payable only if the investment

were sold. The total amount unprovided for is £2,456,000. At present, it is not envisaged that any tax will become payable in the foreseeable future.

9. Loans

2012 2011

£’000 £’000

Amounts falling due

In more than one year but not more than two years 24,500 –

In more than two years but not more than five years – 47,113

24,500 47,113

Bank loans – revolving credit facility and overdraft

The bank loan totalling £24.5m (2011: £34.9m) and overdraft totalling £1.5m (2011: £nil), is secured via a cross guarantee issued from all of the

Group’s subsidiaries excluding the following subsidiaries, Lending Solutions, Homefast Property Services, Linear Mortgage Network, Linear Financial

Services, Templeton LPA, AMF, BDS, Chancellors Associates and LSLi and its subsidiaries.

The bank loans relate to the revolving credit facility. The utilisation of this revolving credit facility may vary each month as long as this does not

exceed the maximum £75m facility (2011: £75m). The Group’s overdraft is also secured on the same facility but can not exceed £5m and the

combined overdraft and revolving credit facility can not exceed £75m (2011: £75m). The banking facility was renewed in 2010 for a further period

until March 2014.

Financial Statements

The interest rate applicable to the facility is LIBOR plus a margin rate of 1.75% (2011: 2%). The margin rate is linked to the leverage ratio of the Group

and the margin rate is reviewed at six monthly intervals.

10. called up share capital

2012 2011

Shares £’000 Shares £’000

Authorised

Ordinary Shares of 0.2p each 500,000,000 1,000 500,000,000 1,000

issued and fully paid:

At 1st January and 31st December 104,158,950 208 104,158,950 208

113