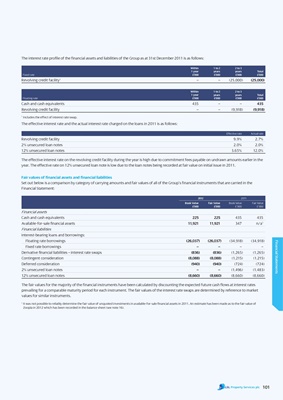

The interest rate profile of the financial assets and liabilities of the Group as at 31st December 2011 is as follows:

Within 1 to 2 2 to 3

1 year years years total

Fixed rate £’000 £’000 £’000 £’000

Revolving credit facility1 – – (25,000) (25,000)

Within 1 to 2 2 to 3

1 year years years total

Floating rate £’000 £’000 £’000 £’000

Cash and cash equivalents 435 – – 435

Revolving credit facility – – (9,918) (9,918)

1

Includes the effect of interest rate swap.

The effective interest rate and the actual interest rate charged on the loans in 2011 is as follows:

Effective rate Actual rate

Revolving credit facility 9.9% 2.7%

2% unsecured loan notes 2.0% 2.0%

12% unsecured loan notes 3.65% 12.0%

The effective interest rate on the revolving credit facility during the year is high due to commitment fees payable on undrawn amounts earlier in the

year. The effective rate on 12% unsecured loan note is low due to the loan notes being recorded at fair value on initial issue in 2011.

Fair values of financial assets and financial liabilities

Set out below is a comparison by category of carrying amounts and fair values of all of the Group’s financial instruments that are carried in the

Financial Statement:

2012 2011

Book Value Fair Value Book Value Fair Value

£’000 £’000 £’000 £’000

Financial assets

Cash and cash equivalents 225 225 435 435

Available-for-sale financial assets 11,921 11,921 347 n/a1

Financial liabilities

Interest-bearing loans and borrowings:

Floating rate borrowings (26,037) (26,037) (34,918) (34,918)

Financial Statements

Fixed rate borrowings – – – –

Derivative financial liabilities – interest rate swaps (836) (836) (1,265) (1,265)

Contingent consideration (8,088) (8,088) (1,215) (1,215)

Deferred consideration (940) (940) (724) (724)

2% unsecured loan notes – – (1,496) (1,483)

12% unsecured loan notes (8,660) (8,660) (8,660) (8,660)

The fair values for the majority of the financial instruments have been calculated by discounting the expected future cash flows at interest rates

prevailing for a comparable maturity period for each instrument. The fair values of the interest rate swaps are determined by reference to market

values for similar instruments.

1

It was not possible to reliably determine the fair value of unquoted investments in available-for-sale financial assets in 2011. An estimate has been made as to the fair value of

Zoopla in 2012 which has been recorded in the balance sheet (see note 16).

101