Notes to the Group Financial Statements (continued)

for the year ended 31st December 2012

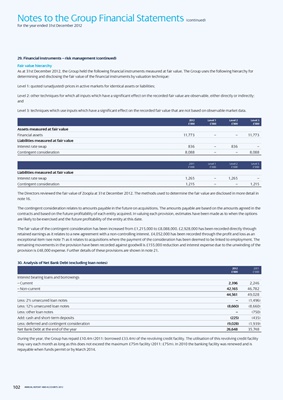

29. Financial instruments – risk management (continued)

Fair value hierarchy

As at 31st December 2012, the Group held the following financial instruments measured at fair value. The Group uses the following hierarchy for

determining and disclosing the fair value of the financial instruments by valuation technique:

Level 1: quoted (unadjusted) prices in active markets for identical assets or liabilities;

Level 2: other techniques for which all inputs which have a significant effect on the recorded fair value are observable, either directly or indirectly;

and

Level 3: techniques which use inputs which have a significant effect on the recorded fair value that are not based on observable market data.

2012 Level 1 Level 2 Level 3

£’000 £’000 £’000 £’000

Assets measured at fair value

Financial assets 11,773 – – 11,773

Liabilities measured at fair value

Interest rate swap 836 – 836 –

Contingent consideration 8,088 – – 8,088

2011 Level 1 Level 2 Level 3

£’000 £’000 £’000 £’000

Liabilities measured at fair value

Interest rate swap 1,265 – 1,265 –

Contingent consideration 1,215 – – 1,215

The Directors reviewed the fair value of Zoopla at 31st December 2012. The methods used to determine the fair value are disclosed in more detail in

note 16.

The contingent consideration relates to amounts payable in the future on acquisitions. The amounts payable are based on the amounts agreed in the

contracts and based on the future profitability of each entity acquired. In valuing each provision, estimates have been made as to when the options

are likely to be exercised and the future profitability of the entity at this date.

The fair value of the contingent consideration has been increased from £1,215,000 to £8,088,000. £2,928,000 has been recorded directly through

retained earnings as it relates to a new agreement with a non-controlling interest. £4,052,000 has been recorded through the profit and loss as an

exceptional item (see note 7) as it relates to acquisitions where the payment of the consideration has been deemed to be linked to employment. The

remaining movements in the provision have been recorded against goodwill is £155,000 reduction and interest expense due to the unwinding of the

provision is £48,000 expense. Further details of these provisions are shown in note 21.

30. Analysis of net Bank Debt (excluding loan notes)

2012 2011

£’000 £’000

Interest bearing loans and borrowings

– Current 2,396 2,246

– Non-current 42,165 46,782

44,561 49,028

Less: 2% unsecured loan notes – (1,496)

Less: 12% unsecured loan notes (8,660) (8,660)

Less: other loan notes – (750)

Add: cash and short-term deposits (225) (435)

Less: deferred and contingent consideration (9,028) (1,939)

Net Bank Debt at the end of the year 26,648 35,748

During the year, the Group has repaid £10.4m (2011: borrowed £33.4m) of the revolving credit facility. The utilisation of this revolving credit facility

may vary each month as long as this does not exceed the maximum £75m facility (2011: £75m). In 2010 the banking facility was renewed and is

repayable when funds permit or by March 2014.

102 ANNUAL REPORT AND ACCOUNTS 2012