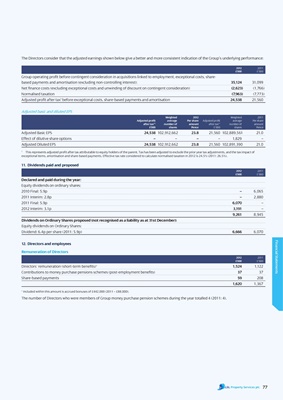

The Directors consider that the adjusted earnings shown below give a better and more consistent indication of the Group’s underlying performance:

2012 2011

£’000 £’000

Group operating profit before contingent consideration in acquisitions linked to employment, exceptional costs, share-

based payments and amortisation (excluding non-controlling interest): 35,124 31,099

Net finance costs (excluding exceptional costs and unwinding of discount on contingent consideration) (2,623) (1,766)

Normalised taxation (7,963) (7,773)

Adjusted profit after tax1 before exceptional costs, share-based payments and amortisation 24,538 21,560

Adjusted basic and diluted EPS

Weighted 2012 Weighted 2011

Adjusted profit average Per share Adjusted profit average Per share

after tax(1) number of amount after tax(1) number of amount

£’000 shares Pence £’000 shares Pence

Adjusted Basic EPS 24,538 102,912,662 23.8 21,560 102,889,561 21.0

Effect of dilutive share options – – – – 1,829 –

Adjusted Diluted EPS 24,538 102,912,662 23.8 21,560 102,891,390 21.0

1

This represents adjusted profit after tax attributable to equity holders of the parent. Tax has been adjusted to exclude the prior year tax adjustments, and the tax impact of

exceptional items, amortisation and share-based payments. Effective tax rate considered to calculate normalised taxation in 2012 is 24.5% (2011: 26.5%).

11. Dividends paid and proposed

2012 2011

£’000 £’000

Declared and paid during the year:

Equity dividends on ordinary shares:

2010 Final: 5.9p – 6,065

2011 Interim: 2.8p – 2,880

2011 Final: 5.9p 6,070 –

2012 Interim: 3.1p 3,191 –

9,261 8,945

Dividends on ordinary Shares proposed (not recognised as a liability as at 31st December):

Equity dividends on Ordinary Shares:

Dividend: 6.4p per share (2011: 5.9p) 6,666 6,070

Financial Statements

12. Directors and employees

Remuneration of Directors

2012 2011

£’000 £’000

Directors’ remuneration (short-term benefits)1 1,524 1,122

Contributions to money purchase pensions schemes (post-employment benefits) 37 37

Share-based payments 59 208

1,620 1,367

1

Included within this amount is accrued bonuses of £442,000 (2011 – £88,000).

The number of Directors who were members of Group money purchase pension schemes during the year totalled 4 (2011: 4).

77