Notes to the Group Financial Statements (continued)

for the year ended 31st December 2012

12. Directors and employees (continued)

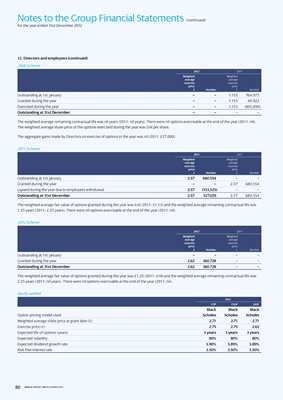

2008 Scheme

2012 2011

Weighted Weighted

average average

exercise exercise

price price

£ number £ Number

Outstanding at 1st January – – 1.155 764,977

Granted during the year – – 1.155 40,922

Exercised during the year – – 1.155 (805,899)

outstanding at 31st December – – – –

The weighted average remaining contractual life was nil years (2011: nil years). There were nil options exercisable at the end of the year (2011: nil).

The weighted average share price of the options exercised during the year was £nil per share.

The aggregate gains made by Directors on exercise of options in the year was nil (2011: £27,000).

2011 Scheme

2012 2011

Weighted Weighted

average average

exercise exercise

price price

£ number £ Number

Outstanding at 1st January 2.57 680,554 – –

Granted during the year – – 2.57 680,554

Lapsed during the year due to employees withdrawal 2.57 (153,525) – –

outstanding at 31st December 2.57 527,029 2.57 680,554

The weighted average fair value of options granted during the year was £nil (2011: £1.13) and the weighted average remaining contractual life was

1.25 years (2011: 2.25 years). There were nil options exercisable at the end of the year (2011: nil).

2012 Scheme

2012 2011

Weighted Weighted

average average

exercise exercise

price price

£ number £ Number

Outstanding at 1st January – – – –

Granted during the year 2.62 360,728 – –

outstanding at 31st December 2.62 360,728 – –

The weighted average fair value of options granted during the year was £1.25 (2011: £nil) and the weighted average remaining contractual life was

2.25 years (2011: nil years). There were nil options exercisable at the end of the year (2011: nil).

Equity-settled

2012

LtiP cSoP SAyE

Black Black Black

Option pricing model used Scholes Scholes Scholes

Weighted average share price at grant date (£) 2.71 2.71 2.71

Exercise price (£) 2.75 2.75 2.62

Expected life of options (years) 3 years 3 years 3 years

Expected volatility 80% 80% 80%

Expected dividend growth rate 3.90% 3.89% 3.89%

Risk free interest rate 3.50% 3.50% 3.50%

80 ANNUAL REPORT AND ACCOUNTS 2012