Notes to the Parent Company Financial Statements (continued)

for the year ended 31st December 2012

4. investments (continued)

At 31st December 2012, the Directors reviewed the fair value of Zoopla. Based on an analysis of the price paid per share in April 2012, an analysis of

the valuation of Zoopla assumed as part of the merger and an analysis of trading subsequent to these events, the Directors determined that the most

appropriate fair value for combined Zoopla Group was £245m, with LSL Group’s share of this being £11.8m. This resulted in a £10.7m valuation uplift

being recorded at December 2012.

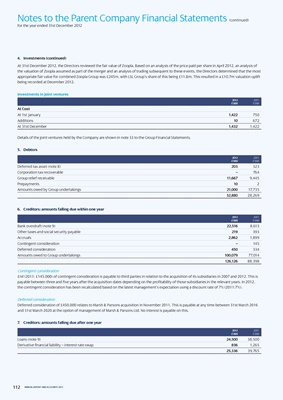

investments in joint ventures

2012 2011

£’000 £’000

At cost

At 1st January 1,422 750

Additions 10 672

At 31st December 1,432 1,422

Details of the joint ventures held by the Company are shown in note 33 to the Group Financial Statements.

5. Debtors

2012 2011

£’000 £’000

Deferred tax asset (note 8) 203 323

Corporation tax recoverable – 764

Group relief receivable 11,667 9,445

Prepayments 10 2

Amounts owed by Group undertakings 21,000 17,735

32,880 28,269

6. creditors: amounts falling due within one year

2012 2011

£’000 £’000

Bank overdraft (note 9) 22,516 8,613

Other taxes and social security payable 219 393

Accruals 2,862 1,899

Contingent consideration – 145

Deferred consideration 450 334

Amounts owed to Group undertakings 100,079 77,014

126,126 88,398

Contingent consideration

£nil (2011: £145,000) of contingent consideration is payable to third parties in relation to the acquisition of its subsidiaries in 2007 and 2012. This is

payable between three and five years after the acquisition dates depending on the profitability of those subsidiaries in the relevant years. In 2012,

the contingent consideration has been recalculated based on the latest management’s expectation using a discount rate of 7% (2011:7%).

Deferred consideration

Deferred consideration of £450,000 relates to Marsh & Parsons acquisition in November 2011. This is payable at any time between 31st March 2016

and 31st March 2020 at the option of management of Marsh & Parsons Ltd. No interest is payable on this.

7. creditors: amounts falling due after one year

2012 2011

£’000 £’000

Loans (note 9) 24,500 38,500

Derivative financial liability – interest rate swap 836 1,265

25,336 39,765

112 ANNUAL REPORT AND ACCOUNTS 2012