Notes to the Parent Company Financial Statements (continued)

for the year ended 31st December 2012

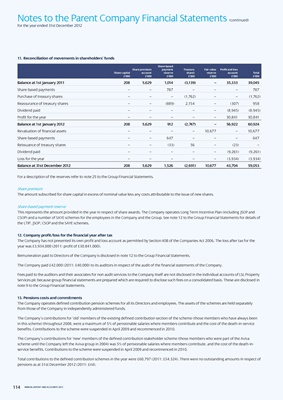

11. Reconciliation of movements in shareholders’ funds

Share-based

Share premium payment treasury Fair value Profit and loss

Share capital account reserve shares reserve account total

£’000 £’000 £’000 £’000 £’000 £’000 £’000

Balance at 1st January 2011 208 5,629 1,014 (3,139) – 35,333 39,045

Share-based payments – – 787 – – – 787

Purchase of treasury shares – – – (1,762) – – (1,762)

Reassurance of treasury shares – – (889) 2,154 – (307) 958

Dividend paid – – – – – (8,945) (8,945)

Profit for the year – – – – – 30,841 30,841

Balance at 1st January 2012 208 5,629 912 (2,747) – 56,922 60,924

Revaluation of financial assets – – – – 10,677 – 10,677

Share-based payments – – 647 – – – 647

Reissuance of treasury shares – – (33) 56 – (23) –

Dividend paid – – – – – (9,261) (9,261)

Loss for the year – – – – – (3,934) (3,934)

Balance at 31st December 2012 208 5,629 1,526 (2,691) 10,677 43,704 59,053

For a description of the reserves refer to note 25 to the Group Financial Statements.

Share premium

The amount subscribed for share capital in excess of nominal value less any costs attributable to the issue of new shares.

Share-based payment reserve

This represents the amount provided in the year in respect of share awards. The Company operates Long Term Incentive Plan (including JSOP and

CSOP) and a number of SAYE schemes for the employees in the Company and the Group. See note 12 to the Group Financial Statements for details of

the LTIP, JSOP, CSOP and the SAYE schemes.

12. company profit/loss for the financial year after tax

The Company has not presented its own profit and loss account as permitted by Section 408 of the Companies Act 2006. The loss after tax for the

year was £3,934,000 (2011: profit of £30,841,000).

Remuneration paid to Directors of the Company is disclosed in note 12 to the Group Financial Statements.

The Company paid £42,000 (2011: £40,000) to its auditors in respect of the audit of the financial statements of the Company.

Fees paid to the auditors and their associates for non audit services to the Company itself are not disclosed in the individual accounts of LSL Property

Services plc because group financial statements are prepared which are required to disclose such fees on a consolidated basis. These are disclosed in

note 9 to the Group Financial Statements.

13. Pensions costs and commitments

The Company operates defined contribution pension schemes for all its Directors and employees. The assets of the schemes are held separately

from those of the Company in independently administered funds.

The Company’s contributions for ‘old’ members of the existing defined contribution section of the scheme (those members who have always been

in this scheme) throughout 2008, were a maximum of 5% of pensionable salaries where members contribute and the cost of the death-in-service

benefits. Contributions to the scheme were suspended in April 2009 and recommenced in 2010.

The Company’s contributions for ‘new’ members of the defined contribution stakeholder scheme (those members who were part of the Aviva

scheme until the Company left the Aviva group in 2004) was 5% of pensionable salaries where members contribute, and the cost of the death-in-

service benefits. Contributions to the scheme were suspended in April 2009 and recommenced in 2010.

Total contributions to the defined contribution schemes in the year were £60,797 (2011: £54,324). There were no outstanding amounts in respect of

pensions as at 31st December 2012 (2011: £nil).

114 ANNUAL REPORT AND ACCOUNTS 2012