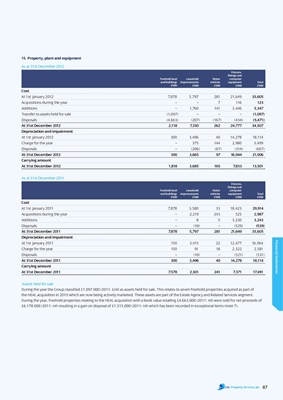

15. Property, plant and equipment

As at 31st December 2012

Fixtures,

fittings and

Freehold land Leasehold Motor computer

and buildings improvements vehicles equipment total

£’000 £’000 £’000 £’000 £’000

cost

At 1st January 2012 7,878 5,797 281 21,649 35,605

Acquisitions during the year – – 7 116 123

Additions – 1,760 141 3,446 5,347

Transfer to assets held for sale (1,097) – – – (1,097)

Disposals (4,663) (207) (167) (434) (5,471)

At 31st December 2012 2,118 7,350 262 24,777 34,507

Depreciation and impairment

At 1st January 2012 300 3,496 40 14,278 18,114

Charge for the year – 375 144 2,980 3,499

Disposals – (206) (87) (314) (607)

At 31st December 2012 300 3,665 97 16,944 21,006

carrying amount

At 31st December 2012 1,818 3,685 165 7,833 13,501

As at 31st December 2011

Fixtures,

fittings and

Freehold land Leasehold Motor computer

and buildings improvements vehicles equipment total

£’000 £’000 £’000 £’000 £’000

cost

At 1st January 2011 7,878 3,580 33 18,423 29,914

Acquisitions during the year – 2,219 243 525 2,987

Additions – 8 5 3,230 3,243

Disposals – (10) – (529) (539)

At 31st December 2011 7,878 5,797 281 21,649 35,605

Depreciation and impairment

Financial Statements

At 1st January 2011 150 3,415 22 12,477 16,064

Charge for the year 150 91 18 2,322 2,581

Disposals – (10) – (521) (531)

At 31st December 2011 300 3,496 40 14,278 18,114

carrying amount

At 31st December 2011 7,578 2,301 241 7,371 17,491

Assets held for sale

During the year the Group classified £1,097,000 (2011: £nil) as assets held for sale. This relates to seven freehold properties acquired as part of

the HEAL acquisition in 2010 which are now being actively marketed. These assets are part of the Estate Agency and Related Services segment.

During the year, freehold properties relating to the HEAL acquisition with a book value totalling £4,663,000 (2011: nil) were sold for net proceeds of

£6,178,000 (2011: nil) resulting in a gain on disposal of £1,515,000 (2011: nil) which has been recorded in exceptional items (note 7).

87