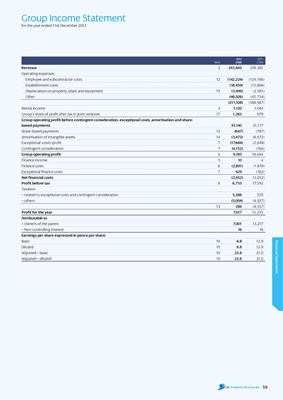

Group Income Statement

for the year ended 31st December 2012

2012 2011

Note £’000 £’000

Revenue 3 243,845 218,381

Operating expenses:

Employee and subcontractor costs 12 (142,224) (124,786)

Establishment costs (18,459) (15,886)

Depreciation on property, plant and equipment 15 (3,499) (2,581)

Other (46,926) (45,734)

(211,108) (188,987)

Rental income 3 1,120 1,044

Group’s share of profit after tax in joint ventures 17 1,283 679

group operating profit before contingent consideration, exceptional costs, amortisation and share-

based payments 35,140 31,117

Share-based payments 12 (647) (787)

Amortisation of intangible assets 14 (3,472) (8,472)

Exceptional (cost)/profit 7 (17,684) (2,048)

Contingent consideration 7 (4,152) (166)

group operating profit 4 9,185 19,644

Finance income 5 10 4

Finance costs 6 (2,891) (1,874)

Exceptional finance costs 7 429 (182)

net financial costs (2,452) (2,052)

Profit before tax 8 6,733 17,592

Taxation

– related to exceptional costs and contingent consideration 5,288 570

– others (5,004) (4,927)

13 284 (4,357)

Profit for the year 7,017 13,235

Attributable to

– Owners of the parent 7,001 13,217

– Non-controlling interest 16 18

Earnings per share expressed in pence per share:

Basic 10 6.8 12.9

Financial Statements

Diluted 10 6.8 12.9

Adjusted – basic 10 23.8 21.0

Adjusted – diluted 10 23.8 21.0

59