below, is measured differently from operating profit or loss in the Group Financial Statements. Head office costs, Group financing (including finance

costs and finance incomes) and income taxes are managed on a Group basis and are not allocated to operating segments.

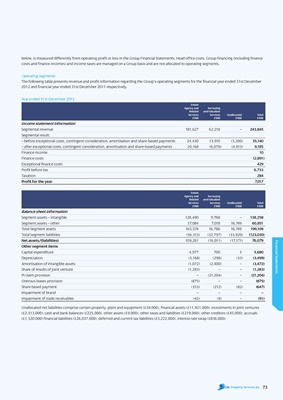

Operating segments

The following table presents revenue and profit information regarding the Group’s operating segments for the financial year ended 31st December

2012 and financial year ended 31st December 2011 respectively.

Year ended 31st December 2012

Estate

Agency and Surveying

Related and Valuation

Services Services unallocated total

£’000 £’000 £’000 £’000

income statement information

Segmental revenue 181,627 62,218 – 243,845

Segmental result:

– before exceptional costs, contingent consideration, amortisation and share-based payments 24,430 13,910 (3,200) 35,140

– after exceptional costs, contingent consideration, amortisation and share-based payments 20,168 (6,070) (4,913) 9,185

Finance income 10

Finance costs (2,891)

Exceptional finance costs 429

Profit before tax 6,733

Taxation 284

Profit for the year 7,017

Estate

Agency and Surveying

Related and Valuation

Services Services unallocated total

£’000 £’000 £’000 £’000

Balance sheet information

Segment assets – intangible 128,490 9,768 – 138,258

Segment assets – other 37,084 7,018 16,749 60,851

Total Segment assets 165,574 16,786 16,749 199,109

Total Segment liabilities (56,313) (32,797) (33,920) (123,030)

net assets/(liabilities) 109,261 (16,011) (17,171) 76,079

Financial Statements

other segment items

Capital expenditure 4,977 700 3 5,680

Depreciation (3,168) (298) (33) (3,499)

Amortisation of intangible assets (1,072) (2,400) – (3,472)

Share of results of joint venture (1,283) – – (1,283)

PI claim provision – (21,204) – (21,204)

Onerous leases provision (875) – – (875)

Share based payment (353) (212) (82) (647)

Impairment of brand – – – –

Impairment of trade receivables (42) (9) – (51)

Unallocated net liabilities comprise certain property, plant and equipment (£39,000), financial assets (£11,921,000), investments in joint ventures

(£2,313,000), cash and bank balances (£225,000), other assets (£9,000), other taxes and liabilities (£219,000), other creditors (£45,000), accruals

(£1,320,000) financial liabilities (£26,037,000), deferred and current tax liabilities (£3,222,000), interest rate swap (£836,000).

73