Notes to the Group Financial Statements (continued)

for the year ended 31st December 2012

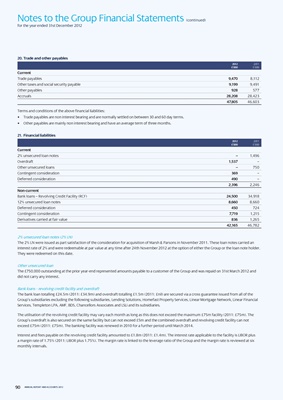

20. trade and other payables

2012 2011

£’000 £’000

current

Trade payables 9,470 8,112

Other taxes and social security payable 9,199 9,491

Other payables 928 577

Accruals 28,208 28,423

47,805 46,603

Terms and conditions of the above financial liabilities:

• Trade payables are non interest bearing and are normally settled on between 30 and 60 day terms.

• Other payables are mainly non interest bearing and have an average term of three months.

21. Financial liabilities

2012 2011

£’000 £’000

current

2% unsecured loan notes – 1,496

Overdraft 1,537 –

Other unsecured loans – 750

Contingent consideration 369 –

Deferred consideration 490 –

2,396 2,246

non-current

Bank loans – Revolving Credit Facility (RCF) 24,500 34,918

12% unsecured loan notes 8,660 8,660

Deferred consideration 450 724

Contingent consideration 7,719 1,215

Derivatives carried at fair value 836 1,265

42,165 46,782

2% unsecured loan notes (2% LN)

The 2% LN were issued as part satisfaction of the consideration for acquisition of Marsh & Parsons in November 2011. These loan notes carried an

interest rate of 2% and were redeemable at par value at any time after 24th November 2012 at the option of either the Group or the loan note holder.

They were redeemed on this date.

Other unsecured loan

The £750,000 outstanding at the prior year-end represented amounts payable to a customer of the Group and was repaid on 31st March 2012 and

did not carry any interest.

Bank loans - revolving credit facility and overdraft

The bank loan totalling £24.5m (2011: £34.9m) and overdraft totalling £1.5m (2011: £nil) are secured via a cross guarantee issued from all of the

Group’s subsidiaries excluding the following subsidiaries, Lending Solutions, Homefast Property Services, Linear Mortgage Network, Linear Financial

Services, Templeton LPA, AMF, BDS, Chancellors Associates and LSLi and its subsidiaries.

The utilisation of the revolving credit facility may vary each month as long as this does not exceed the maximum £75m facility (2011: £75m). The

Group’s overdraft is also secured on the same facility but can not exceed £5m and the combined overdraft and revolving credit facility can not

exceed £75m (2011: £75m). The banking facility was renewed in 2010 for a further period until March 2014.

Interest and fees payable on the revolving credit facility amounted to £1.8m (2011: £1.4m). The interest rate applicable to the facility is LIBOR plus

a margin rate of 1.75% (2011: LIBOR plus 1.75%). The margin rate is linked to the leverage ratio of the Group and the margin rate is reviewed at six

monthly intervals.

90 ANNUAL REPORT AND ACCOUNTS 2012