Notes to the Group Financial Statements (continued)

for the year ended 31st December 2012

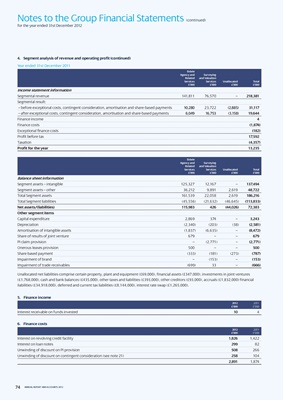

4. Segment analysis of revenue and operating profit (continued)

Year ended 31st December 2011

Estate

Agency and Surveying

Related and Valuation

Services Services unallocated total

£’000 £’000 £’000 £’000

income statement information

Segmental revenue 141,811 76,570 – 218,381

Segmental result:

– before exceptional costs, contingent consideration, amortisation and share-based payments 10,280 23,722 (2,885) 31,117

– after exceptional costs, contingent consideration, amortisation and share-based payments 6,049 16,753 (3,158) 19,644

Finance income 4

Finance costs (1,874)

Exceptional finance costs (182)

Profit before tax 17,592

Taxation (4,357)

Profit for the year 13,235

Estate

Agency and Surveying

Related and Valuation

Services Services unallocated total

£’000 £’000 £’000 £’000

Balance sheet information

Segment assets – intangible 125,327 12,167 – 137,494

Segment assets – other 36,212 9,891 2,619 48,722

Total Segment assets 161,539 22,058 2,619 186,216

Total Segment liabilities (45,556) (21,632) (46,645) (113,833)

net assets/(liabilities) 115,983 426 (44,026) 72,383

other segment items

Capital expenditure 2,869 374 – 3,243

Depreciation (2,340) (203) (38) (2,581)

Amortisation of intangible assets (1,837) (6,635) – (8,472)

Share of results of joint venture 679 – – 679

PI claim provision – (2,771) – (2,771)

Onerous leases provision 500 – – 500

Share based payment (333) (181) (273) (787)

Impairment of brand – (153) – (153)

Impairment of trade receivables (699) 33 – (666)

Unallocated net liabilities comprise certain property, plant and equipment (£69,000), financial assets (£347,000), investments in joint ventures

(£1,768,000), cash and bank balances (£435,000), other taxes and liabilities (£393,000), other creditors (£93,000), accruals (£1,832,000) financial

liabilities (£34,918,000), deferred and current tax liabilities (£8,144,000), interest rate swap (£1,265,000).

5. Finance income

2012 2011

£’000 £’000

Interest receivable on funds invested 10 4

6. Finance costs

2012 2011

£’000 £’000

Interest on revolving credit facility 1,826 1,422

Interest on loan notes 299 82

Unwinding of discount on PI provision 508 266

Unwinding of discount on contingent consideration (see note 21) 258 104

2,891 1,874

74 ANNUAL REPORT AND ACCOUNTS 2012