Notes to the Parent Company Financial Statements (continued)

for the year ended 31st December 2012

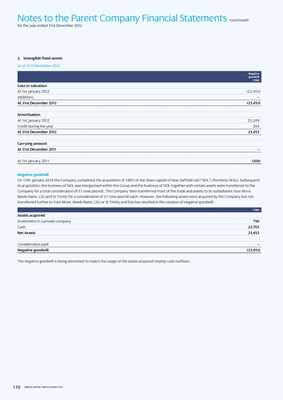

2. intangible fixed assets

As at 31st December 2012

negative

goodwill

£’000

cost or valuation

At 1st January 2012 (23,453)

Additions –

At 31st December 2012 (23,453)

Amortisation

At 1st January 2012 23,249

Credit during the year 204

At 31st December 2012 23,453

carrying amount

At 31st December 2011 –

At 1st January 2011 (204)

negative goodwill

On 15th January 2010 the Company completed the acquisition of 100% of the share capital of New Daffodil Ltd (“NDL”) (formerly HEAL). Subsequent

to acquisition, the business of NDL was reorganised within the Group and the business of NDL together with certain assets were transferred to the

Company for a total consideration of £1 (one pound). The Company then transferred most of the trade and assets to its subsidiaries Your Move,

Reeds Rains, LSLi and St Trinity for a consideration of £1 (one pound) each. However, the following assets were acquired by the Company but not

transferred further to Your Move, Reeds Rains, LSLi or St Trinity and this has resulted in the creation of negative goodwill:

£’000

Assets acquired

Investment in a private company 750

Cash 22,703

net Assets 23,453

Consideration paid –

negative goodwill (23,453)

The negative goodwill is being amortised to match the usage of the assets acquired (mainly cash outflow).

110 ANNUAL REPORT AND ACCOUNTS 2012