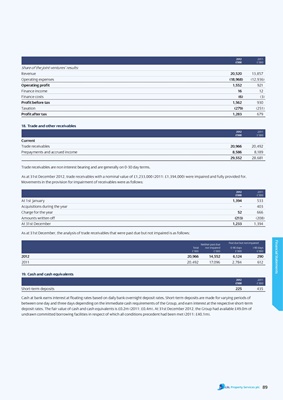

2012 2011

£’000 £’000

Share of the joint ventures’ results:

Revenue 20,520 13,857

Operating expenses (18,968) (12,936)

operating profit 1,552 921

Finance income 16 12

Finance costs (6) (3)

Profit before tax 1,562 930

Taxation (279) (251)

Profit after tax 1,283 679

18. trade and other receivables

2012 2011

£’000 £’000

current

Trade receivables 20,966 20,492

Prepayments and accrued income 8,586 8,189

29,552 28,681

Trade receivables are non interest bearing and are generally on 0-30 day terms.

As at 31st December 2012, trade receivables with a nominal value of £1,233,000 (2011: £1,394,000) were impaired and fully provided for.

Movements in the provision for impairment of receivables were as follows:

2012 2011

£’000 £’000

At 1st January 1,394 533

Acquisitions during the year – 403

Charge for the year 52 666

Amounts written off (213) (208)

At 31st December 1,233 1,394

As at 31st December, the analysis of trade receivables that were past due but not impaired is as follows:

Financial Statements

Past due but not impaired

Neither past due

Total nor impaired 0-90 days >90 days

£’000 £’000 £’000 £’000

2012 20,966 14,552 6,124 290

2011 20,492 17,096 2,784 612

19. cash and cash equivalents

2012 2011

£’000 £’000

Short-term deposits 225 435

Cash at bank earns interest at floating rates based on daily bank overnight deposit rates. Short-term deposits are made for varying periods of

between one day and three days depending on the immediate cash requirements of the Group, and earn interest at the respective short-term

deposit rates. The fair value of cash and cash equivalents is £0.2m (2011: £0.4m). At 31st December 2012, the Group had available £49.0m of

undrawn committed borrowing facilities in respect of which all conditions precedent had been met (2011: £40.1m).

89