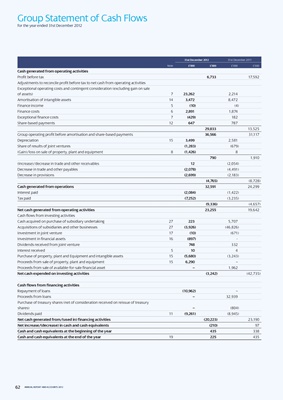

Group Statement of Cash Flows

for the year ended 31st December 2012

31st December 2012 31st December 2011

Note £’000 £’000 £’000 £’000

cash generated from operating activities

Profit before tax 6,733 17,592

Adjustments to reconcile profit before tax to net cash from operating activities

Exceptional operating costs and contingent consideration (excluding gain on sale

of assets) 7 23,262 2,214

Amortisation of intangible assets 14 3,472 8,472

Finance income 5 (10) (4)

Finance costs 6 2,891 1,874

Exceptional finance costs 7 (429) 182

Share-based payments 12 647 787

29,833 13,525

Group operating profit before amortisation and share-based payments 36,566 31,117

Depreciation 15 3,499 2,581

Share of results of joint ventures (1,283) (679)

(Gain)/loss on sale of property, plant and equipment 8 (1,426) 8

790 1,910

(Increase)/decrease in trade and other receivables 12 (2,054)

Decrease in trade and other payables (2,078) (4,491)

Decrease in provisions (2,699) (2,183)

(4,765) (8,728)

cash generated from operations 32,591 24,299

Interest paid (2,084) (1,422)

Tax paid (7,252) (3,235)

(9,336) (4,657)

net cash generated from operating activities 23,255 19,642

Cash flows from investing activities

Cash acquired on purchase of subsidiary undertaking 27 223 5,707

Acquisitions of subsidiaries and other businesses 27 (3,926) (46,826)

Investment in joint venture 17 (10) (671)

Investment in financial assets 16 (897) -

Dividends received from joint venture 748 332

Interest received 5 10 4

Purchase of property, plant and Equipment and intangible assets 15 (5,680) (3,243)

Proceeds from sale of property, plant and equipment 15 6,290 –

Proceeds from sale of available-for-sale financial asset – 1,962

net cash expended on investing activities (3,242) (42,735)

cash flows from financing activities

Repayment of loans (10,962) –

Proceeds from loans – 32,939

Purchase of treasury shares (net of consideration received on reissue of treasury

shares) – (804)

Dividends paid 11 (9,261) (8,945)

net cash generated from/(used in) financing activities (20,223) 23,190

net increase/(decrease) in cash and cash equivalents (210) 97

cash and cash equivalents at the beginning of the year 435 338

cash and cash equivalents at the end of the year 19 225 435

62 ANNUAL REPORT AND ACCOUNTS 2012