67

City of Glasgow College Annual Report & Accounts 2019-20

CITY OF GLASGOW COLLEGE

NOTES TO THE FINANCIAL STATEMENTS

FOR THE 12 MONTHS ENDED 31 JULY 2020

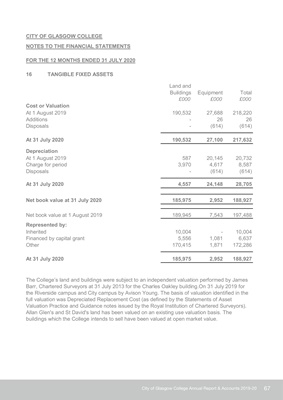

16 TANGIBLE FIXED ASSETS

Land and

Buildings Equipment Total

£000 £000 £000

Cost or Valuation

At 1 August 2019 190,532 27,688 218,220

Additions - 26 26

Disposals - (614) (614)

At 31 July 2020 190,532 27,100 217,632

Depreciation

At 1 August 2019 587 20,145 20,732

Charge for period 3,970 4,617 8,587

Disposals - (614) (614)

At 31 July 2020 4,557 24,148 28,705

Net book value at 31 July 2020 185,975 2,952 188,927

Net book value at 1 August 2019 189,945 7,543 197,488

Represented by:

Inherited 10,004 - 10,004

Financed by capital grant 5,556 1,081 6,637

Other 170,415 1,871 172,286

At 31 July 2020 185,975 2,952 188,927

The College's land and buildings were subject to an independent valuation performed by James

Barr, Chartered Surveyors at 31 July 2013 for the Charles Oakley building.On 31 July 2019 for

the Riverside campus and City campus by Avison Young. The basis of valuation identified in the

full valuation was Depreciated Replacement Cost (as defined by the Statements of Asset

Valuation Practice and Guidance notes issued by the Royal Institution of Chartered Surveyors).

Allan Glen's and St David's land has been valued on an existing use valuation basis. The

buildings which the College intends to sell have been valued at open market value.