68 City of Glasgow College Annual Report & Accounts 2019-20

CITY OF GLASGOW COLLEGE

NOTES TO THE FINANCIAL STATEMENTS

12 months ended 12 months ended

FOR THE 12 MONTHS ENDED 31 JULY 2020 31 July 2020 31 July 2019

£000 £000

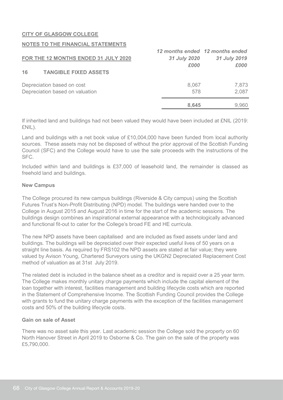

16 TANGIBLE FIXED ASSETS

Depreciation based on cost 8,067 7,873

Depreciation based on valuation 578 2,087

8,645 9,960

New Campus

Gain on sale of Asset

There was no asset sale this year. Last academic session the College sold the property on 60

North Hanover Street in April 2019 to Osborne & Co. The gain on the sale of the property was

£5,790,000.

The related debt is included in the balance sheet as a creditor and is repaid over a 25 year term.

The College makes monthly unitary charge payments which include the capital element of the

loan together with interest, facilities management and building lifecycle costs which are reported

in the Statement of Comprehensive Income. The Scottish Funding Council provides the College

with grants to fund the unitary charge payments with the exception of the facilities management

costs and 50% of the building lifecycle costs.

Land and buildings with a net book value of £10,004,000 have been funded from local authority

sources. These assets may not be disposed of without the prior approval of the Scottish Funding

Council (SFC) and the College would have to use the sale proceeds with the instructions of the

SFC.

If inherited land and buildings had not been valued they would have been included at £NIL (2019:

£NIL).

Included within land and buildings is £37,000 of leasehold land, the remainder is classed as

freehold land and buildings.

The College procured its new campus buildings (Riverside & City campus) using the Scottish

Futures Trust's Non-Profit Distributing (NPD) model. The buildings were handed over to the

College in August 2015 and August 2016 in time for the start of the academic sessions. The

buildings design combines an inspirational external appearance with a technologically advanced

and functional fit-out to cater for the College's broad FE and HE curricula.

The new NPD assets have been capitalised and are included as fixed assets under land and

buildings. The buildings will be depreciated over their expected useful lives of 50 years on a

straight line basis. As required by FRS102 the NPD assets are stated at fair value; they were

valued by Avison Young, Chartered Surveyors using the UKGN2 Depreciated Replacement Cost

method of valuation as at 31st July 2019.