74 City of Glasgow College Annual Report & Accounts 2019-20

CITY OF GLASGOW COLLEGE

NOTES TO THE FINANCIAL STATEMENTS

12 months ended12 months ended

FOR THE 12 MONTHS ENDED 31 JULY 2020 31 July 2020 31 July 2019

£000 £000

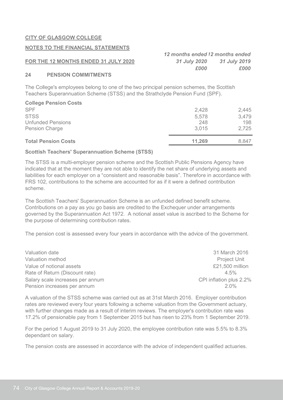

24 PENSION COMMITMENTS

College Pension Costs

SPF 2,428 2,445

STSS 5,578 3,479

Unfunded Pensions 248 198

Pension Charge 3,015 2,725

Total Pension Costs 11,269 8,847

Scottish Teachers' Superannuation Scheme (STSS)

Valuation date 31 March 2016

Valuation method Project Unit

Value of notional assets £21,500 million

Rate of Return (Discount rate) 4.5%

Salary scale increases per annum

Pension increases per annum 2.0%

For the period 1 August 2019 to 31 July 2020, the employee contribution rate was 5.5% to 8.3%

dependant on salary.

The pension costs are assessed in accordance with the advice of independent qualified actuaries.

A valuation of the STSS scheme was carried out as at 31st March 2016. Employer contribution

rates are reviewed every four years following a scheme valuation from the Government actuary,

with further changes made as a result of interim reviews. The employer's contribution rate was

17.2% of pensionable pay from 1 September 2015 but has risen to 23% from 1 September 2019.

The College's employees belong to one of the two principal pension schemes, the Scottish

Teachers Superannuation Scheme (STSS) and the Strathclyde Pension Fund (SPF).

The STSS is a multi-employer pension scheme and the Scottish Public Pensions Agency have

indicated that at the moment they are not able to identify the net share of underlying assets and

liabilities for each employer on a "consistent and reasonable basis". Therefore in accordance with

FRS 102, contributions to the scheme are accounted for as if it were a defined contribution

scheme.

The Scottish Teachers' Superannuation Scheme is an unfunded defined benefit scheme.

Contributions on a pay as you go basis are credited to the Exchequer under arrangements

governed by the Superannuation Act 1972. A notional asset value is ascribed to the Scheme for

the purpose of determining contribution rates.

The pension cost is assessed every four years in accordance with the advice of the government.

CPI inflation plus 2.2%