76 City of Glasgow College Annual Report & Accounts 2019-20

CITY OF GLASGOW COLLEGE

NOTES TO THE FINANCIAL STATEMENTS

FOR THE 12 MONTHS ENDED 31 JULY 2020

24 PENSION COMMITMENTS

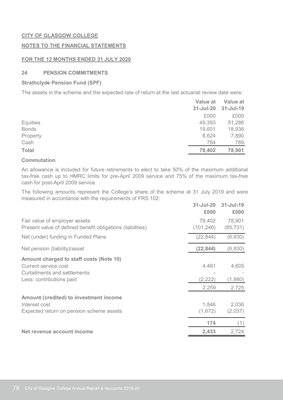

Strathclyde Pension Fund (SPF)

The assets in the scheme and the expected rate of return at the last actuarial review date were:

Value at

31-Jul-20

Value at

31-Jul-19

£000 £000

Equities 49,393 51,286

Bonds 19,601 18,936

Property 8,624 7,890

Cash 784 789

Total 78,402 78,901

Commutation

31-Jul-20 31-Jul-19

£000 £000

Fair value of employer assets 78,402 78,901

Present value of defined benefit obligations (liabilities) (101,246) (85,731)

Net (under) funding in Funded Plans (22,844) (6,830)

Net pension (liability)/asset (22,844) (6,830)

Amount charged to staff costs (Note 10)

Current service cost 4,481 4,605

Curtailments and settlements - Less:

contributions paid (2,222) (1,880)

2,259 2,725

Amount (credited) to investment income

Interest cost 1,846 2,036

Expected return on pension scheme assets (1,672) (2,037)

174 (1)

Net revenue account income 2,433 2,724

The following amounts represent the College's share of the scheme at 31 July 2019 and were

measured in accordance with the requirements of FRS 102:

An allowance is included for future retirements to elect to take 50% of the maximum additional

tax-free cash up to HMRC limits for pre-April 2009 service and 75% of the maximum tax-free

cash for post-April 2009 service.