CENTRAL AND EASTERN EUROPE

UniCredit is a market leader in Central and Eastern

Europe, it has a broad network of roughly 3,800 branches.

Its regional footprint is diverse, and include a direct

presence in 19 countries. It is ranked in the top

five in 11 of these countries*. In fact the CEE now

accounts for 26.2 percent of the Group’s reveneus**.

The region’s economic environment is expected to

improve, with GDP growth forecast to rise from

2.5 percent in 2012 to 2.9 percent in 2013 and to

3.4 percent in 2014. With Q4 2012 representing the

bottom of the cycle, a sequential improvement in

the numbers should be evident by Q1 2013.

competitive labor costs, flexible labor markets and

Among the factors expected to aid recovery following a gradual recovery in foreign direct investment.

a weak 2012, is a gradual improvement in external Nevertheless, the primary challenge for the region

demand, with the potential to drive an increase in remains a structural shortfall in savings, with the

industrial production and exports across the region. exception of Russia.

Domestic demand should be supported by easier

financing conditions, as central banks have cut

interest rates and governments now have ample

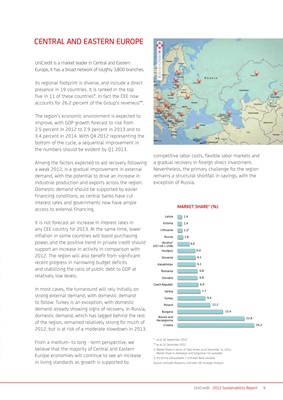

MARKET SHARE2 (%)

access to external financing.

Latvia 1.4

It is not forecast an increase in interest rates in Estonia 1.4

any CEE country for 2013. At the same time, lower Lithuania 1.5*

inflation in some countries will boost purchasing Russia 1.8

power, and the positive trend in private credit should Ukraine3 4.0

(UCI UA + USB)

support an increase in activity in comparison with Hungary 6.0

2012. The region will also benefit from significant Slovenia 6.1

recent progress in narrowing budget deficits Kazakhstan 6.1

and stabilizing the ratio of public debt to GDP at Romania 6.8

relatively low levels. Slovakia 6.8

Czech Republic 6.9

In most cases, the turnaround will rely initially on Serbia 7.7

strong external demand, with domestic demand Turkey 9.4

to follow. Turkey is an exception, with domestic Poland 11.2

demand already showing signs of recovery. In Russia, Bulgaria 15.4

domestic demand, which has lagged behind the rest Bosnia and 22.8

Herzegovina

of the region, remained relatively strong for much of Croatia 26.2

2012, but is at risk of a moderate slowdown in 2013.

* as at 30 September, 2012.

From a medium- to long - term perspective, we ** as at 31 December 2012.

believe that the majority of Central and Eastern 2. Market Share in terms of Total Assets as at December 31, 2012.

Market Share in Azerbaijan and Kyrgyzstan not available.

Europe economies will continue to see an increase 3. Pro-forma (Ukrsotsbank + UniCredit Bank Ukraine).

in living standards as growth is supported by Source: UniCredit Research, UniCredit CEE Strategic Analysis.

UniCredit ·UniCredit · 2012 Sustainability Report

2012 Consolidated Reports and Accounts 9

5