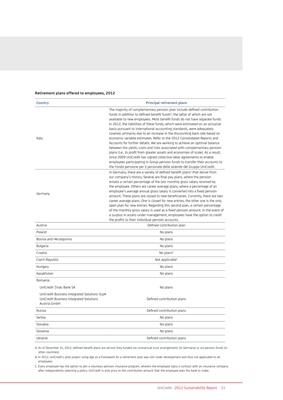

Retirement plans offered to employees, 2012

Country Principal retirement plans

The majority of complementary pension plan include defined contribution

funds in addition to defined benefit fundsA, the latter of which are not

available to new employees. Most benefit funds do not have separate funds.

In 2012, the liabilities of these funds, which were estimated on an actuarial

basis pursuant to international accounting standards, were adequately

covered, primarily due to an increase in the discounting back rate based on

Italy economic variable estimates. Refer to the 2012 Consolidated Reports and

Accounts for further details. We are working to achieve an optimal balance

between the yields, costs and risks associated with complementary pension

plans (i.e., to profit from greater assets and economies of scale). As a result,

since 2009 UniCredit has signed collective labor agreements to enable

employees participating in Group pension funds to transfer their accounts to

the Fondo pensione per il personale delle aziende del Gruppo UniCredit.

In Germany, there are a variety of defined benefit plansA that derive from

our company’s history. Several are final pay plans, where the pension

entails a certain percentage of the last monthly gross salary received by

the employee. Others are career average plans, where a percentage of an

employee’s average annual gross salary is converted into a fixed pension

Germany

amount. These plans are closed to new beneficiaries. Currently, there are two

career average plans. One is closed for new entries, the other one is the only

open plan for new entries. Regarding this second plan, a certain percentage

of the monthly gross salary is used as a fixed pension amount. In the event of

a surplus in assets under management, employees have the option to credit

the profits to their individual pension accounts.

Austria Defined contribution plan

Poland No plans

Bosnia and Herzegovina No plans

Bulgaria No plans

Croatia No plansB

Czech Republic Not applicableC

Hungary No plans

Kazakhstan No plans

Romania

UniCredit Țiriac Bank SA No plans

UniCredit Business Integrated Solutions ScpA

UniCredit Business Integrated Solutions Defined contribution plans

Austria GmbH

Russia Defined contribution plans

Serbia No plans

Slovakia No plans

Slovenia No plans

Ukraine Defined contribution plans

A. As of December 31, 2012, defined benefit plans are almost fully funded via contractual trust arrangements (in Germany) or via pension funds (in

other countries).

B. In 2012, UniCredit’s pilot project using age as a framework for a retirement plan was still under development and thus not applicable to all

employees.

C. Every employee has the option to join a voluntary pension insurance program, wherein the employee signs a contract with an insurance company

after independently selecting a policy. UniCredit is only privy to the contribution amount that the employee asks the bank to make.

UniCredit · 2012 Sustainability Report 33