Socially Responsible Investments (SRI)

By becoming a signatory to the United Nations Principles for Responsible Investment (UNPRI) in March 2009,

Pioneer Global Asset Management SpA joined an initiative launched by the UN Secretary-General to advance six

best-practice principles among asset owners and investment managers. In alignment with its commitment to the

UNPRI, Pioneer Global Asset Management SpA expanded its Proxy Voting Policy to include environmental, social and

corporate governance (ESG) issues.

Moreover, Pioneer Global Asset Management SpA has defined its search, investment, control and monitoring processes

to ensure their alignment with the transparency guidelines of the European Sustainable Investment Forum (Eurosif).

Pioneer Global Asset Management SpA provides several asset-management products that are designed to

maximize returns while adhering to ethical and sustainable principles:

• Pioneer Obbligazionario Euro Corporate Etico a distribuzione (“Euro Bond Ethical Corporate Fund”)

The fund’s investment strategy is designed to achieve capital appreciation over the medium term. This is

accomplished by investing in fixed income instruments issued by companies with business models that meet

high standards of social, human and ecological responsibility.

• Pioneer Funds – Global Ecology – E Class

The fund’s investment strategy is designed to achieve capital appreciation over the medium-to-long term.

This is accomplished by investing at least two-thirds of the fund’s assets in a range of equities and equity-

linked instruments issued by companies manufacturing or producing environmentally friendly products or

technologies that help to create a cleaner, healthier environment. Such companies include those operating

in the fields of air pollution control, alternative energy, recycling, waste incineration, wastewater treatment,

water purification and biotechnology.

• Pioneer Funds Austria – Ethik Fonds

This is a balanced fund designed to achieve long-term capital growth while generating regular returns. The basic fund

portfolio is composed of 30 percent global equities and 70 percent euro bonds. An investment is considered “ethical”

when the issuer’s business model meets established sustainability standards.

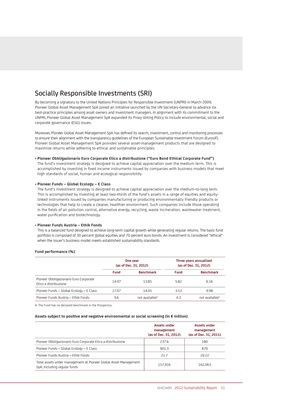

Fund performance (%)

One year Three years annualized

(as of Dec. 31, 2012) (as of Dec. 31, 2012)

Fund Benchmark Fund Benchmark

Pioneer Obbligazionario Euro Corporate

14.97 13.85 5.82 6.16

Etico a distribuzione

Pioneer Funds – Global Ecology – E Class 17.07 14.05 3.53 9.98

Pioneer Funds Austria – Ethik Fonds 9.6 not availableA

4.3 not availableA

A. The Fund has no declared benchmark in the Prospectus.

Assets subject to positive and negative environmental or social screening (in € million)

Assets under Assets under

management management

(as of Dec. 31, 2012) (as of Dec. 31, 2011)

Pioneer Obbligazionario Euro Corporate Etico a distribuzione 237.6 180

Pioneer Funds – Global Ecology – E Class 901.3 870

Pioneer Funds Austria – Ethik Fonds 21.7 20.22

Total assets under management at Pioneer Global Asset Management

157,916 162,063

SpA, including regular funds

UniCredit · 2012 Sustainability Report 51